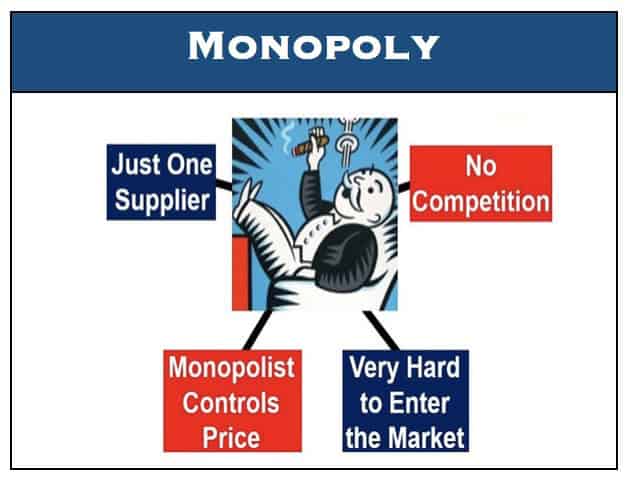

If you are redistributing all or part of this book in a digital format, Then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a print format, Want to cite, share, or modify this book? This book uses the The discussion here begins by examining how demand and supply determine the price and the quantity sold in markets for goods and services, and how changes in demand and supply lead to changes in prices and quantities. This chapter introduces the economic model of demand and supply-one of the most powerful models in all of economics. Other factors were at work during those 18 months, such as increases in supply and decreases in the demand for crude oil. The likely reason is that people drive more in the summer, and are also willing to pay more for gas, but that does not explain how steeply gas prices fell. Over recent decades, gasoline prices in midsummer have averaged about 10 cents per gallon more than their midwinter low. Why was the average price of gasoline in the United States $3.71 per gallon in June 2014? Why did the price for gasoline fall sharply to $1.96 per gallon by January 2016? To explain these price movements, economists focus on the determinants of what gasoline buyers are willing to pay and what gasoline sellers are willing to accept.Īs it turns out, the price of gasoline in June of any given year is nearly always higher than the price in January of that same year. Consider a price most of us contend with weekly: that of a gallon of gas. When economists talk about prices, they are less interested in making judgments than in gaining a practical understanding of what determines prices and why prices change. These examples represent an interesting facet of demand and supply. Visit this website to read a list of bizarre items that have been purchased for their ties to celebrities. People usually react to purchases like these in two ways: their jaw drops because they think these are high prices to pay for such goods or they think these are rare, desirable items and the amount paid seems right. A collector spends a small fortune for a few drawings by John Lennon. If many organic foods are locally grown, would they not take less time to get to market and therefore be cheaper? What are the forces that keep those prices from coming down? Turns out those forces have quite a bit to do with this chapter’s topic: demand and supply.Īn auction bidder pays thousands of dollars for a dress Whitney Houston wore. In short, organic is part of the mainstream.Įver wonder why organic food costs more than conventional food? Why, say, does an organic Fuji apple cost $1.99 a pound, while its conventional counterpart costs $1.49 a pound? The same price relationship is true for just about every organic product on the market. Now it is available in most grocery stores. At one time, consumers had to go to specialty stores or farmers' markets to find organic produce. Rent seeking: Behaviour by producers in a market that improves the welfare of one but at the expense of another.Organic food is increasingly popular, not just in the United States, but worldwide.Pure monopoly: The only supplier in an industry - with a 100 percent market share.Price discrimination: Charging different prices to different groups of consumers for the same product for reasons not associated with the marginal cost of supply.Predatory pricing: A deliberate strategy of driving competitors out of the market by setting very low prices or selling below AVC.Natural monopoly: When long-run average cost (LRAC) falls continuously over a large range of output so only one firm can fully exploit economies of scale.Monopoly profit: Supernormal profit to a firm with market power, achieved when price (AR) > average cost.Market power: Power to raise price above marginal cost without fear of losing supernormal profits to new entrants.Market liberalisation: Introducing competition in previously monopolistic sectors such as energy supply, retail banking and postal services.Limit pricing: When a firm sets price low enough to discourage new entrants into the market.Industry regulator: Appointed by government to oversee how a market works and the outcomes that result for producers and consumers.Entry barriers: Strategies used to protect the market power of established firms whilst maintain supernormal profits.Dominant firm: Business with more than 40 percent of market share.Deadweight loss: Loss in producer & consumer surplus due to an inefficient level of production.Concentration ratio: Measures the proportion of an industry's output or employment accounted for by the largest firms.Bi-lateral monopoly: Where a monopsony buyer faces a monopsony seller in a market.Monopoly power in markets - some key terms to revise

0 kommentar(er)

0 kommentar(er)